For most small and mid-sized businesses, Dubai business setup cost in 2025 starts from around AED 8,000–14,000 for a basic free zone with no visa and can go upwards of AED 25,000–45,000+ for a more robust mainland trading setup with visas and office. Final cost depends on structure, activity, visas, and professional support.

- Mon-Fri 8:00 am-6:00 pm

- +971554475703

- info@businessandbeyond.ae

Business Setup in Dubai – Trusted Consultants with 100% Approval

Your Dubai Company, Approved. Or We Handle the Fixes. Experience the UAE’s only risk-free business setup with 100% approval, fixed pricing, and a dedicated PRO expert.

Contact Now

Business Setup in Dubai & UAE

Mainland, Free Zone & Offshore Company Formation — Explained Clearly

Business Setup in Dubai, UAE

Business & Beyond Consulting LLC FZ is a Dubai-based business setup consultancy supporting founders, SMEs, and international investors with end-to-end company formation in Dubai and across the UAE. We advise on legal structure, jurisdiction, licensing, visas, tax registration, banking readiness, and ongoing compliance, ensuring businesses are established correctly from day one — not merely registered. Our work sits at the intersection of business setup, UAE corporate regulation, and long-term compliance, allowing clients to operate with clarity, credibility, and regulatory confidence.

What a Business Setup Consultant in Dubai Actually Does

A business setup consultant in Dubai is responsible for more than registering a trade licence.

The role involves:

Assessing whether a mainland, free zone, or offshore structure is legally and commercially appropriate

Ensuring the licensed activity matches real operations (a critical banking and tax requirement)

Managing approvals, documentation, and authority coordination

Aligning the company with UAE corporate tax, VAT, ESR, UBO, and AML obligations

Preparing the business for bank account opening and future audits

Business & Beyond operates as an advisory partner, not a document processor — helping clients avoid structural mistakes that often require costly restructuring later.

Business Setup in Dubai & UAE — Jurisdiction Coverage

Starting a business in Dubai?

We can help you set up in a Freezone, Mainland or Offshore.

Mainland Company Setup (Dubai & UAE)

Mainland companies in Dubai are licensed by the Department of Economy & Tourism (DET) and permit businesses to operate without geographic restrictions across the UAE. This structure is designed for companies that intend to engage directly with the local market, including both public and private sector clients.

Mainland business setup is particularly appropriate for organisations providing services or goods within the UAE, such as trading companies, retail outlets, hospitality businesses, healthcare providers, and other regulated activities that require local operational presence or external approvals. It is also the preferred structure for businesses planning to work with government entities, semi-government bodies, or large UAE-based corporates, where mainland licensing is often a prerequisite.

Free Zone Company Setup (UAE)

Free zone companies in the UAE are licensed by individual free zone authorities and are widely used by businesses that operate internationally or follow asset-light and digital business models. This structure is particularly suitable for companies engaged in international trade, cross-border services, e-commerce, software, digital platforms, and consulting activities that do not require unrestricted onshore trading within the UAE.

Free zone entities are also commonly used for holding companies, intellectual property ownership, regional headquarters, and group structuring, where operational efficiency and simplified governance are key considerations. Many free zones offer streamlined incorporation processes, flexible office solutions, and bundled visa options, making them attractive for startups, SMEs, and international entrepreneurs seeking a predictable and cost-effective entry into the UAE market.

How Business & Beyond Is Structurally Different

Most business setup firms in Dubai focus on speed of licence issuance.

Business & Beyond focuses on whether the company will survive regulatory, banking, and tax scrutiny after incorporation.

This difference matters.

Many UAE companies face problems 6–18 months after setup — not at incorporation — when:

corporate tax filings begin,

bank reviews intensify, or

ownership and substance are examined by regulators.

Our advisory model is built specifically to prevent these downstream failures.

Structural Review Before Incorporation (Not After)

Before any licence is applied for, we perform a pre-incorporation structural review covering:

Whether the licensed activity accurately reflects real commercial operations

Whether the proposed structure is bankable under current UAE KYC standards

Whether the company will fall under corporate tax, VAT, ESR, or DNFBP regimes

Whether ownership and control disclosures will raise UBO or compliance flags

Most consultants address these issues only after problems arise.

We address them before the company exists.

Compliance Is Embedded, Not Added Later

Rather than “adding compliance services” later, we embed compliance logic into the structure itself:

Corporate tax exposure is assessed at the structural level, not at filing stage

VAT applicability is reviewed before licence issuance, not after thresholds are crossed

ESR relevance is evaluated based on actual economic activity, not assumptions

AML and DNFBP risk is flagged early for businesses in regulated or sensitive sectors

As a result, the company is formed in a way that can be defended, not retrofitted.

Setup Designed for Banking Acceptance

Bank account rejection is one of the most common post-setup failures in Dubai.

We therefore design each company with:

a defensible business narrative,

activity descriptions aligned with actual revenue generation, and

documentation that matches bank compliance expectations, not marketing language.

This significantly reduces the risk of delayed or declined corporate bank accounts.

Long-Term Operability, Not Just Registration

A company that is:

licensed but unbankable,

compliant only on paper, or

misaligned with its real activity

is not operationally viable in today’s UAE environment.

Business & Beyond structures companies to remain functional, review-proof, and scalable — through audits, tax filings, bank reviews, and regulatory updates.

Business Setup Process in Dubai (Step-by-Step)

Step 1 — Feasibility & Regulatory Fit

Before any licence is selected, we assess your business model, ownership structure, and target markets. This early-stage review identifies whether your activity triggers external approvals, sector-specific regulations, or compliance obligations such as corporate tax, VAT, ESR, or AML. The objective is to confirm that your proposed structure is legally viable and sustainable in the UAE.

Step 2 — Jurisdiction & Legal Structure Selection

Based on feasibility, we determine whether a mainland, free zone, or offshore structure is most appropriate. This decision is guided by operational scope, tax implications, visa eligibility, banking considerations, and future expansion plans. Selecting the correct structure at this stage avoids restructuring and regulatory complications later.

Step 3 — Licensing & Authority Approvals

Once the structure is defined, we manage trade name reservation, activity classification, and all relevant approvals with the Department of Economy & Tourism or the applicable free zone authority. Where required, we coordinate external regulatory approvals to ensure the licence accurately reflects your actual operations.

Step 4 — Tax, Visa & Compliance Alignment

After licence issuance, we align your company with UAE post-setup requirements. This includes assessing corporate tax and VAT registration obligations, structuring visa eligibility, and ensuring UBO, ESR, and compliance frameworks are correctly addressed from the outset.

Step 5 — Banking Readiness & Ongoing Support

The final stage focuses on banking preparedness and long-term compliance. We help position your business for corporate bank account opening by aligning documentation, substance, and operational narratives with banking expectations. Ongoing support ensures your business remains compliant as regulations evolve.

Our Business Setup Services in Dubai

As a leading business setup consultant in Dubai, we provide everything under one roof —

from company formation to accounting and PRO services.

We provide a full-stack solution, not just a licence.

Here’s how we help:

Company Formation & Structuring

We help clients establish mainland LLCs, professional licences, Dubai free zone companies, offshore and holding structures, as well as complex group setups, cross-border entities and corporate restructurings tailored to their operational and strategic needs.

Licence & Regulatory Approvals

We manage all DET and free zone approvals, guide activity classification and licence selection, and secure any required external regulatory approvals for a fully compliant setup.

Tax, Accounting & Compliance

Through our group’s accounting and tax specialists, we provide corporate tax registration and advisory, VAT compliance, bookkeeping, and audit coordination to ensure your business meets every UAE financial and regulatory requirement.

Visa & PRO Services

We handle investor, partner and employee visas, family visa applications, status changes, renewals and all PRO tasks across government and semi-government departments to streamline your onboarding and residency process.

Banking & Financial Advisory

We support corporate bank account opening from documentation to compliance preparation, advise on substance and KYC expectations, and connect you with suitable UAE banks and fintech partners when appropriate.

Ongoing Compliance (Beyond Setup)

We manage your ongoing regulatory obligations including UBO filings, ESR submissions, AML framework guidance and updates on new UAE regulations that may impact your operations.

UAE Compliance Considerations You Cannot Ignore

Business setup in the UAE now operates within a defined regulatory framework.

Key areas include:

Corporate Tax

Most UAE companies are subject to corporate tax rules, including registration, record-keeping, and annual filings.

VAT

VAT registration, invoicing, returns, and documentation are mandatory once thresholds or criteria are met.

UBO & Company Registers

Accurate and timely ownership disclosures are required and routinely reviewed by banks and authorities.

Economic Substance Regulations (ESR)

Certain activities require proof of substance within the UAE.

AML / DNFBP Obligations

Designated Non-Financial Businesses and Professions must maintain AML frameworks, risk assessments, and reporting mechanisms.

Business & Beyond integrates these requirements into the setup process, avoiding post-incorporation compliance gaps.

Cost of Business Setup in Dubai — What Actually Drives the Price

There is no single “package price” for business setup in Dubai because the real cost is determined by regulatory exposure, not marketing bundles. Advertised prices often reflect only licence issuance, excluding the structural requirements that determine whether the company can operate, open a bank account, or remain compliant.

The Five Cost Drivers That Actually Matter

When establishing a company in Dubai, total cost is primarily driven by:

1. Jurisdiction Risk Profile

Mainland, free zone, and offshore structures carry different compliance, audit, and banking expectations, which directly affect total setup and post-setup cost.

2. Licensed Activity vs Actual Operations

Costs increase when:

activities require external approvals, or

the licence must be structured carefully to match real revenue generation (a banking requirement).

3. Ownership & Control Complexity

Multiple shareholders, foreign ownership layers, or corporate shareholders increase:

documentation,

UBO disclosure complexity, and

bank due-diligence requirements.

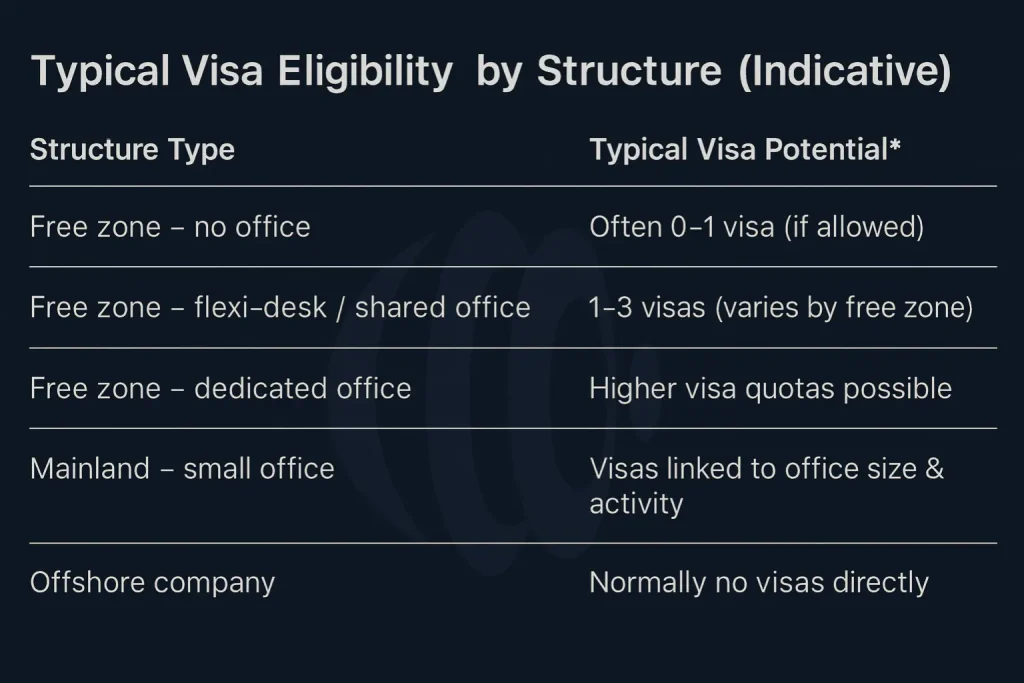

4. Visa & Substance Requirements

Investor and employee visas, office size, and physical presence obligations directly impact:

licence fees,

immigration costs, and

economic substance exposure.

5. Banking & Compliance Readiness

Companies with:

international transactions,

high-risk geographies, or

regulated activities

require additional preparation to meet bank and regulatory scrutiny — a cost frequently omitted from “starter packages”.

Business Setup Is a One-Time Event.

Regulatory Compliance Is Ongoing.

Most company formation problems in Dubai do not arise during incorporation.

They arise 6–18 months later — when banks review accounts, the FTA requests filings, or a regulatory obligation is missed.

Business & Beyond is structured to support companies after the licence is issued, when real operational, tax, and compliance exposure begins. Our post-setup involvement focuses on regulatory continuity, not add-on services.

Post-Incorporation Support That Regulators and Banks Expect

Once your company is operational, we continue to assist with:

Financial & Record-Keeping Alignment

Ensuring accounting records, invoicing practices, and financial statements reflect actual business activity and meet UAE regulatory standards.

Corporate Tax & VAT Governance

Supporting tax registration, filing readiness, documentation, and interpretation of evolving UAE corporate tax and VAT requirements as they apply to your specific structure.

UBO, ESR & Statutory Filings

Managing ownership disclosures, economic substance notifications, and annual reporting obligations to avoid penalties, banking disruption, or licence issues.

Banking & Compliance Reviews

Periodic review of your business profile, transaction patterns, and documentation to align with bank KYC expectations and reduce the risk of account restrictions or rejections.

Structural & Advisory Support as You Scale

Advising on changes such as:

Adding shareholders

Expanding activities

Moving from free zone to mainland

Group structuring or holding entities

Preparing for audits or due diligence

Why This Matters (And Why Most Consultants Fail Here)

Company formation in Dubai has become compliance-driven, not paperwork-driven.

Authorities, banks, and tax bodies now evaluate:

Substance, not just licences

Actual operations, not stated activities

Financial consistency, not promises

Business & Beyond remains involved beyond incorporation to ensure your company continues to meet these expectations as rules evolve.

This approach reduces:

Bank account freezes or closures

Tax penalties and late filing fines

Forced restructuring

Regulatory scrutiny triggered by inconsistencies

Approximate ranges combining government fees + basic professional fees. Bank account assistance, premium office, multiple activities, complex shareholder structures, tax planning or additional compliance services will impact final cost.

At Business & Beyond, we provide a clear, written cost breakdown before you commit — no hidden mark-ups or surprise “mandatory extras”.

Visa & Residency Eligibility With Dubai Business Setup

Setting up a company in Dubai is often the gateway to UAE residency.

Common Visa Options Linked to Business Setup

Investor / Partner Visa – for business owners / shareholders

Employment Visas – for your employees and team

Family Sponsorship – spouse, children, sometimes parents (subject to rules)

Golden Visa – possible via qualifying investment or business structures (subject to current criteria)

Let's Start Talking Now About Next Project

+971554475703

Who Typically Requires Business Setup Services in Dubai

We commonly support:

Professional and management consultancies

Trading and general trading companies

E-commerce and online businesses

Technology and SaaS startups

Manufacturing and industrial ventures

Holding companies and family offices

International entrepreneurs entering the UAE market

If an activity is regulated or high-risk, feasibility is assessed before incorporation.

Corporate Bank Account & Financial Structuring Support

Opening a corporate bank account in the UAE is increasingly compliance-driven.

We help you:

Prepare a complete business profile banks understand

Align your licence, activity, and narrative with actual operations

Pre-empt likely KYC questions

Choose banks that fit your country of residence, turnover, and risk profile

We also highlight, in advance, scenarios where:

Your business model may be high-risk from a bank’s perspective

You may need additional substance, documentation or controls

Ready to Start Your Business Setup in Dubai?

You don’t need to navigate licensing, tax, visas, banking and compliance alone.

Let Business & Beyond Consulting LLC FZ act as your Dubai setup partner and long-term advisor.

Latest Insights

-

1. How much does it cost to start a business in Dubai in 2025?

-

2. How long does business setup in Dubai take?

In straightforward cases, a free zone licence can be issued in a few days once documents are ready. Mainland setups may take longer due to additional approvals. Visas, Emirates ID and bank account opening add time. Realistically, expect 2–6 weeks from decision to being fully operational, depending on complexity.

-

3. Can foreigners own 100% of a business in Dubai?

Yes. Most commercial and professional activities now allow 100% foreign ownership in both mainland and free zones, subject to the specific activity and regulator. Some strategic or restricted activities still have special rules. We confirm your activity’s ownership options before incorporation.

-

4. Is mainland or free zone better for my business?

If you mainly serve UAE residents or need a physical presence (retail, restaurant, clinic, on-site services), mainland is often better. If you serve international clients, operate online, and want lower setup cost, a free zone may be ideal. The right answer depends on your sector, clients, and future plans.

-

5. Do I need to be in Dubai to set up a company?

Many free zones and some mainland processes allow remote incorporation via digital signing, especially for new companies. However, you will typically need to be present for visa processes (medical, biometrics) and sometimes bank meetings. We’ll advise you precisely based on your nationality, bank and chosen structure.

-

6. What documents are required for business setup in Dubai?

Common documentation includes: passport copies, proof of address, passport-size photos, business plan or profile for certain activities, and sometimes reference letters or corporate documents if a company is a shareholder. Regulators and banks may request additional KYC documents depending on your profile.

-

7. What is the minimum share capital for a Dubai company?

Many free zones and mainland structures have no paid-up capital requirement or only a nominal requirement (e.g., stated but not blocked in a bank). Some activities or free zones may set specific capital requirements. We clarify this upfront so you can plan investment and documentation accordingly.

-

8. Do I need a local sponsor or local service agent in Dubai?

For most commercial activities, the previous 51/49 local sponsorship model has been relaxed, and 100% foreign ownership is possible. Certain professional licences may still use a local service agent on a fixed-fee basis, but without equity in the company. Exact requirements depend on your activity and emirate.

-

9. Can I run an online business with a Dubai company?

Yes. Dubai is a leading hub for e-commerce and online services. You can obtain a free zone or mainland licence suitable for online business, e-commerce, or service delivery, then integrate with payment gateways, logistics partners and marketplaces, subject to category and platform policies.

-

10. What taxes will my Dubai company pay?

You may be subject to corporate tax (9%), VAT (5%), and other levies depending on your activity and profits. Free zone companies can, in some circumstances, qualify for special tax treatment if they meet qualifying free zone person criteria. Personal income is generally not taxed. We assess your tax position as part of your setup.

-

11. Is bookkeeping and accounting mandatory in Dubai?

Yes. Under corporate tax and other regulations, companies are expected to maintain proper, auditable accounts. Many free zones and mainland structures require audited financial statements periodically. We help you set up basic accounting systems, processes and timelines from the beginning.

-

12. What is a trade licence in Dubai?

A trade licence (or commercial/professional licence) is the official permission issued by the relevant authority that authorises your company to carry out specific activities. Without a valid trade licence, your business cannot legally operate, invoice, or hire employees in the UAE.

-

13. Can I have multiple activities under one Dubai licence?

Yes, subject to regulator rules. Many authorities allow multiple related activities under one licence. Some combinations are restricted or require separate approvals. We help design an activity mix that is both compliant and commercially flexible for your current and future plans.

-

14. Can I upgrade or change my licence later?

In many cases you can add activities, change premises, or upgrade licences over time. Some changes require approvals, documentation or restructuring. It is usually cheaper and cleaner to plan correctly at the beginning, but we also assist with amendments and restructuring when needed.

-

15. How difficult is it to open a corporate bank account in Dubai?

Banking has become more compliance-focused. For well-structured, legitimate businesses with clear documentation and a credible profile, opening a bank account is still very achievable. Challenges arise for high-risk sectors or inconsistent profiles. We help you prepare a realistic banking strategy.

-

16. Do I need physical office space in Dubai?

Requirements vary. Some free zones allow flexi-desk or shared office models, while mainland entities often require a physical office or co-working agreement (Ejari). Banks and regulators may also expect substance that matches your declared activity and business plan.

-

17. Can I move from a free zone to mainland later?

You cannot usually “convert” a free zone licence directly into mainland, but you can set up a new mainland entity, migrate operations, and manage tax and contractual transitions. Structuring your initial setup with future plans in mind can significantly reduce complexity.

-

18. How do I know if my activity triggers ESR or AML obligations?

Certain activities such as headquarters, holding, distribution, finance, IP and DNFBP-related services (e.g., real estate brokerage, corporate services, accounting) may trigger ESR or AML obligations. We review your planned business and flag these obligations explicitly so you can comply.

-

19. Can I sponsor my family through my Dubai company?

In many cases, yes. Once you have a valid residence visa, you may be able to sponsor your spouse, children and sometimes parents, subject to income thresholds, documentation and current rules. We guide you through sponsorship options and timelines.

-

20. Is it possible to start with a low-cost option and upgrade later?

Yes, but there are trade-offs. Low-cost packages can be a good entry point, but may limit visas, banking options or activity scope. We help you decide when a lean start makes sense and when it’s safer to invest slightly more upfront to avoid expensive changes later.

-

21. What is the difference between Dubai free zones?

Each free zone has its own rules, costs, visa policies and positioning. Some focus on tech, some on media, some on trading or general business. We compare free zones based on your activity, budget, target markets, visa needs and banking profile.

-

22. Can I hold international assets or shares through a UAE company?

Yes. Many clients use UAE holding or offshore companies to hold foreign subsidiaries, investments or IP. This can support structuring, treaty access and succession planning, subject to proper tax and legal advice in all relevant countries.

-

23. What happens if I don’t comply with tax or filing requirements?

Non-compliance with corporate tax, VAT, ESR or UBO can lead to financial penalties, banking issues, licence problems and reputational risk. We help you implement a simple compliance calendar, documentation process and review cycle so you stay ahead of deadlines.

-

24. Can Business & Beyond handle both setup and ongoing compliance?

Yes. We specialise in business setup in Dubai and coordinate with experienced accounting, tax and compliance professionals to support you after incorporation. This includes bookkeeping, VAT, corporate tax, ESR, UBO and advisory as your business evolves.

-

25. How do I get started with Business & Beyond?

Simply share a few details about your business idea, nationality, budget and preferred timeline. We’ll schedule a free consultation, outline your best options, and send you a clear 2025 cost and timeline estimate — with no obligation to proceed.

If you need high-quality, professional, and friendly business consulting, look no further than Business & Beyond Consulting.

Contact

Bromley – Kent , London UK

Copyright © 2025 – Designed by Business & Beyond – Dubai, UAE