Yes. IFZA allows full foreign ownership under the free zone framework, subject to compliance and KYC requirements.

- Mon-Fri 8:00 am-6:00 pm

- +971554475703

- info@businessandbeyond.ae

IFZA Business Setup

- Home

- IFZA Business Setup

IFZA Business Setup in Dubai — Bank-Ready, Tax-Ready, Compliance-First

Setting up a company in International Free Zone Authority (IFZA) is no longer about speed or price alone.

In 2026, founders are assessed by banks, tax authorities, and regulators on how well their business is structured after the license is issued — not just how fast it was obtained.

Business & Beyond delivers IFZA company formation that is:

Structurally correct

Corporate-Tax aligned

UBO-compliant

Bank-ready from day one

This is not cheap formation.

This is usable, defensible, long-term company setup.

What is IFZA company formation?

IFZA company formation is the process of incorporating a Free Zone company in Dubai under the International Free Zone Authority, choosing licensed activities, legal structure, and (if needed) visa allocation, then maintaining post-incorporation compliance such as Corporate Tax readiness, UBO registers, and proper accounting records.

Why IFZA works for international founders (when structured correctly)

IFZA is commonly chosen by founders who require:

A Dubai-registered company for international consulting, trading, or digital services

100% foreign ownership under a free zone framework

Flexible visa planning (from zero-visa to multi-visa structures)

Lower fixed overheads compared to premium ecosystem free zones

Straightforward licensing — without operational confusion

IFZA Is Well-Suited For:

Professional & management consultancies

Trading and general trading companies

E-commerce and online service models

Holding and investment structures

International founders entering the UAE market

IFZA in 2026 — What Most Consultants Still Don’t Explain

1. “0% Corporate Tax” Is Conditional — Not Automatic

IFZA companies fall under UAE Corporate Tax Law (Federal Decree-Law No. 47 of 2022).

A 0% outcome applies only if the company qualifies as a Qualifying Free Zone Person and earns qualifying income under Cabinet and Ministerial Decisions.

This requires:

Correct activity classification

Controlled transaction profiles

Proper financial records (often audited)

Substance consistent with the business model

Incorrect structuring converts “0%” into 9% Corporate Tax exposure.

2. ESR Has Ended — But Substance Has NOT

Economic Substance Regulations no longer apply for financial years starting on or after 1 January 2023.

However:

Banks still assess economic substance

Corporate Tax relies on substance and activity reality

Paper companies face compliance escalation

Substance is no longer a form — it is an evidence standard.

3. UBO Compliance Is Non-Negotiable

Every IFZA company must:

Maintain accurate Ultimate Beneficial Owner (UBO) records

Keep ownership/control registers updated

Ensure UBO data matches banking, tax, and licensing files

Most banking delays originate from UBO inconsistencies, not missing forms.

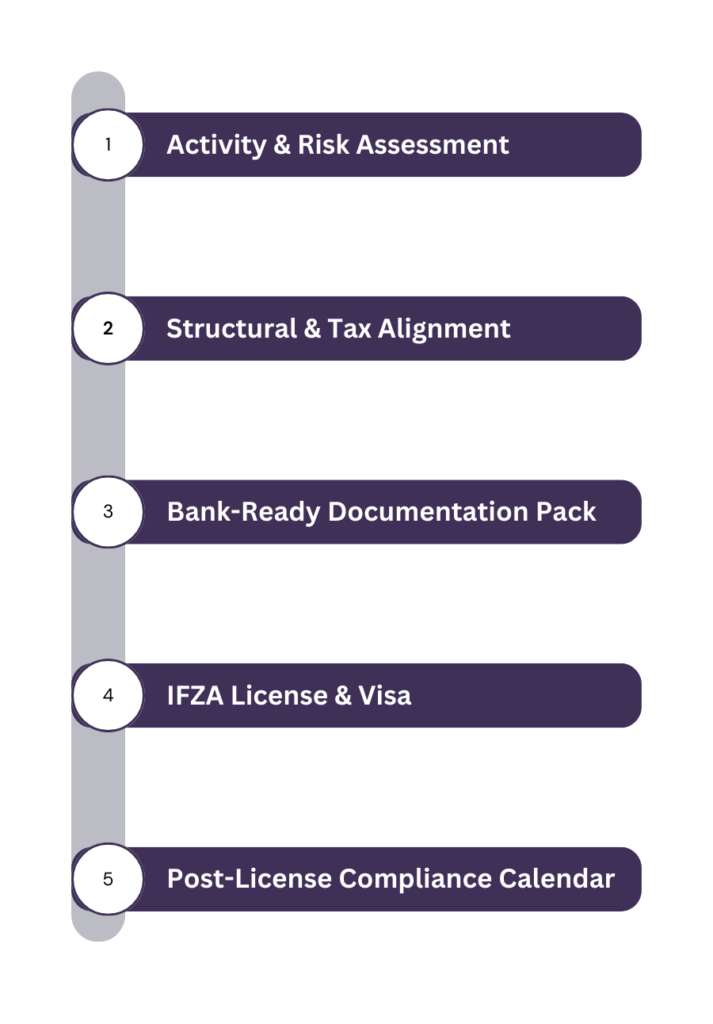

The Business & Beyond IFZA Setup Method (Bank & Regulator Focused)

Step 1 — Activity & Risk Assessment

We assess:

License suitability

Banking risk profile

Corporate Tax classification impact

AML exposure indicators

Step 2 — Structural & Tax Alignment

We structure the company considering:

Free zone tax eligibility

Shareholding clarity

Future scalability

Exit and restructuring risks

Step 3 — Bank-Ready Documentation Pack

Prepared upfront:

Business profile & transaction narrative

UBO and ownership evidence

Contract & invoicing logic

Accounting framework

Step 4 — IFZA License, Establishment Card & Visas

Incorporation managed end-to-end with accuracy, not shortcuts.

Step 5 — Post-License Compliance Calendar

You receive a clear roadmap for:

Tax registrations

Accounting cycles

Renewals

Governance updates

Corporate Banking Readiness for IFZA Companies

Banks do not reject IFZA companies because of IFZA.

They reject companies because:

Activities don’t match invoices

Transaction flows are unclear

Ownership is inconsistent

No financial records exist

“Virtual company” risk is high

Our Bank-Ready File Includes:

Clear activity-to-revenue mapping

Ownership & UBO clarity

Counterparty explanation

Expected transaction values & geographies

Accounting & tax readiness confirmation

This dramatically improves approval probability.

IFZA Costs — What Actually Determines Pricing

IFZA pricing depends on:

Number of visas required

Office / workspace selection

Business activities chosen

Shareholder structure

License duration

Promotional prices change frequently.

We issue written, accurate estimates only after reviewing your structure.

This avoids:

Hidden future costs

Forced amendments

Banking contradictions

Post-Incorporation Obligations (Most Founders Underestimate This)

After your IFZA license is issued, you must manage:

Corporate Tax

Registration

Classification

Compliance filings

VAT (If Applicable)

Threshold monitoring

Registration

Returns

Accounting & Financial Records

Monthly bookkeeping

Financial statements

Audit readiness where required

UBO & Governance

Register maintenance

Updates on ownership/control change

Renewals & Amendments

License renewal

Activity changes

Visa allocations

Ignoring these leads to:

Bank freezes

Tax penalties

License suspension

IFZA vs Other UAE Free Zones (Quick Decision Guide)

| Factor | IFZA | DMCC | Meydan | RAKEZ |

|---|---|---|---|---|

| Best for | Lean international businesses | Ecosystem & brand | Fast solo setups | Trading / industrial |

| Cost structure | Flexible | Higher | Moderate | Value-oriented |

| Banking scrutiny | Medium–High | High | Medium | Medium |

| Tax planning importance | High | High | High | High |

Correct zone selection depends on your transaction story — not setup price.

Critical Risk Warnings (Read This Before Proceeding)

“0% tax” is conditional — not guaranteed

Multi-activity licenses can weaken banking

No accounting = future tax exposure

UBO inconsistencies trigger audits

Cheap setups cost more later

Business setup errors compound over time.

Ready to Set Up IFZA the Right Way?

If you want:

A company banks accept

A structure tax authorities respect

Compliance handled before problems arise

Business & Beyond is ready to assist.

Frequently Asked Questions

-

Can foreigners own 100% of an IFZA company?

-

Is IFZA automatically 0% Corporate Tax?

No. A 0% outcome depends on qualifying free zone conditions and income classification.

-

How long does IFZA company setup take?

Timelines vary by activity and shareholder profile. License issuance is fast, but banking and compliance readiness must run in parallel.

-

Can I combine multiple activities under one IFZA license?

Often yes, but activities must be logically compatible and bank-acceptable.

-

Do I need an office?

Workspace requirements depend on visa allocation and operational needs.

-

Do IFZA companies need audited financials?

In many cases, yes — especially for tax positioning and banking credibility.

If you need high-quality, professional, and friendly business consulting, look no further than Business & Beyond Consulting.

Contact

Bromley – Kent , London UK

Copyright © 2025 – Designed by Business & Beyond – Dubai, UAE