- Mon-Fri 8:00 am-6:00 pm

- +971554475703

- info@businessandbeyond.ae

DIFC Company Setup

- Home

- DIFC Company Setup

DIFC Company Setup – An Insider, Regulator-Aware Guide for Serious Founders

DIFC Explained Like an Insider

The Dubai International Financial Centre is not simply a “premium free zone” in Dubai. It is a distinct legal jurisdiction, operating under its own English-language common law framework, independent courts, and autonomous regulator.

This distinction matters more than most founders realise.

DIFC is governed by:

Its own Companies Law

Its own Registrar of Companies

Its own Courts, independent of onshore UAE courts

A regulatory perimeter designed for international finance, holding, and cross-border activity

Unlike most UAE free zones, DIFC was never designed for:

Trading companies with high-volume local sales

Cost-optimised SME structures

Visa-driven incorporations

DIFC exists primarily to support:

Regional and international holding companies

Investment, advisory, and professional services firms

Family offices, funds, SPVs, and structured entities

Groups requiring legal certainty and enforceability under common law

DIFC Company Types – Reality vs Marketing Claims

Prescribed Company

Often marketed as a “light” DIFC structure, Prescribed Companies are not a shortcut. They are intended for specific use cases, typically linked to:

Holding assets or shares

Group restructurings

Family office or SPV purposes

DIFC assesses:

The parent or sponsor entity

Jurisdictional credibility

Whether the structure aligns with DIFC’s economic purpose

Using a Prescribed Company for an operating business is a common reason applications stall.

Private Company Limited by Shares

This is the default operating vehicle in DIFC and the structure banks understand best.

However, DIFC evaluates:

The commercial rationale

The proposed activity vs license scope

Whether substance expectations are realistically achievable

A mismatch between business narrative and license category is one of the most common internal rejection triggers.

Branch / Holding Structures

Branches are scrutinised more heavily than advertised.

DIFC focuses on:

Where control and decision-making actually sits

Whether DIFC is being used merely as a “badge”

Consistency between global structure and DIFC presence

Key reality:

DIFC does not reject weak applications loudly.

It simply does not advance them.

DIFC Licensing Categories (What Banks Care About)

The DIFC license category influences banking, tax perception, audit scope, and ongoing compliance.

Commercial License

Typically used for:

Trading-linked structures

Holding entities with income-generating assets

Banks expect:

Clear source of funds

Real contractual flows

Strong UBO transparency

Professional License

Common for:

Advisory

Consultancy

Professional services

Banks scrutinise:

Founder credentials

Fee models

Client geography

Holding License

Used for:

Group ownership

Investment holding

Passive income structures

Banks assess:

Asset location

Dividend flows

Intercompany governance

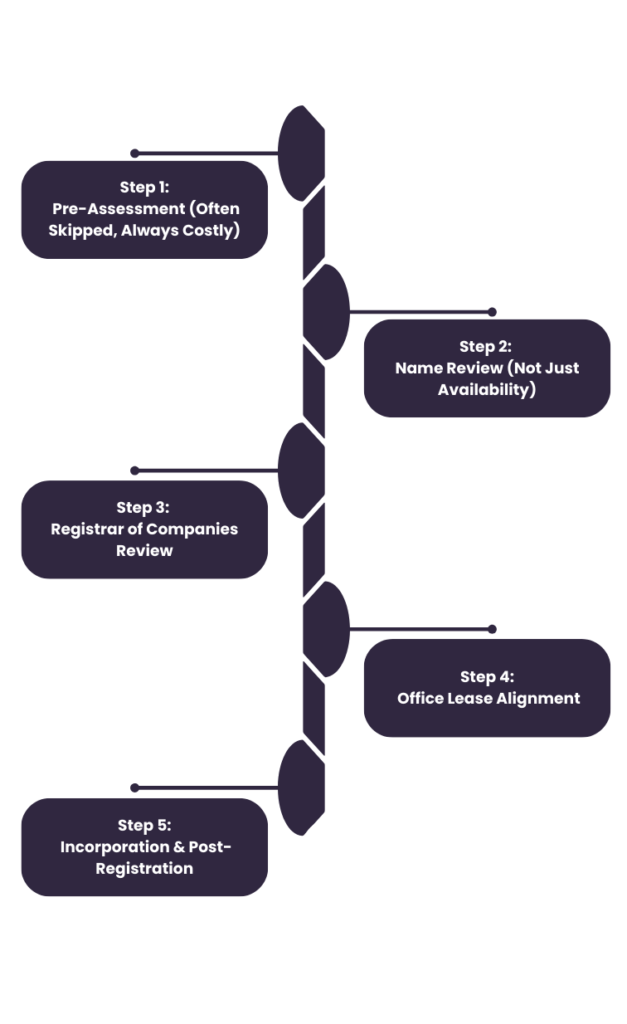

DIFC Setup Process – What Actually Happens

Step 1: Pre-Assessment (Often Skipped, Always Costly)

DIFC internally evaluates:

Business model credibility

Jurisdictional fit

Substance logic

Skipping this step is why timelines fail later.

Step 2: Name Review (Not Just Availability)

Names are reviewed for:

Market positioning

Regulatory sensitivity

Misleading implications

Names implying regulated activity without approval frequently stall.

Step 3: Registrar of Companies Review

This is where most “delays” occur.

The Registrar examines:

Shareholding clarity

UBO structure

Alignment between documents and narrative

Step 4: Office Lease Alignment

Securing an office too early or too late can derail timelines.

DIFC expects:

Office type consistent with license

Substance proportionality

Real occupancy plans

Step 5: Incorporation & Post-Registration

Incorporation is not the end.

It is the start of banking, tax, and compliance scrutiny.

Realistic timelines (not brochure claims):

Well-prepared structures: 6–8 weeks

Complex or cross-border cases: 8–12+ weeks

DIFC Office Requirements – The Most Misunderstood Area

DIFC allows:

Physical offices

Approved flexi or shared arrangements

However, banks apply a stricter standard than DIFC.

Common failure pattern:

“DIFC accepted the office, but the bank rejected the account.”

Banks evaluate:

Actual occupancy

Staffing plausibility

Operational reality

An office that is technically compliant but commercially weak is one of the fastest ways to lose banking credibility.

Banking for DIFC Companies (Hard Truth Section)

DIFC does not guarantee a bank account.

Banks assess:

Founder profile and nationality

Source of wealth and funds

Business activity risk

Jurisdictional exposure

Substance vs structure alignment

Common misconceptions:

“DIFC companies are automatically low risk”

“Premium free zone equals easy banking”

In reality, DIFC entities are often more heavily scrutinised, not less.

Banking success depends on:

Pre-banking structuring

Correct license-office alignment

Clear transaction logic

Weak consultants focus on incorporation.

Strong advisors design the structure backwards from banking.

DIFC Tax, Audit & Compliance Reality (2026-Ready)

Corporate Tax

The “0% DIFC tax” narrative is widely misunderstood.

DIFC entities are subject to UAE Corporate Tax law, with outcomes depending on:

Qualifying income

Economic substance

Related-party arrangements

Misclassification can expose DIFC companies to unexpected tax positions.

Audit Obligations

Most DIFC companies are required to:

Appoint an auditor

File audited financial statements

Banks routinely request audited accounts even where regulators do not immediately enforce them.

ESR, UBO & AML

DIFC applies:

Robust UBO disclosure

AML alignment consistent with international standards

Substance expectations aligned with global scrutiny

Compared to Mainland, DIFC entities are often perceived by banks as:

More transparent

More enforceable

But less tolerant of weak governance

DIFC vs ADGM vs Mainland (Decision Matrix)

| Factor | DIFC | ADGM | Mainland |

|---|---|---|---|

| Legal System | Common law | Common law | Civil law |

| Courts | Independent DIFC Courts | Independent ADGM Courts | Onshore UAE courts |

| Banking Perception | High scrutiny | High scrutiny | Variable |

| Cost Base | High | High | Medium |

| Compliance Burden | High | High | Moderate |

| Ideal Use | Holdings, advisory, finance | Funds, SPVs, fintech | Operating businesses |

Abu Dhabi Global Market and DIFC are peers, not substitutes.

Mainland is often more practical for revenue-driven operations.

Common DIFC Setup Mistakes (From Real Cases)

Choosing DIFC for prestige, not suitability

Selecting the wrong license category

Using minimal offices that banks reject

Over-engineering structures

Attempting banking after incorporation instead of before

Each of these mistakes is avoidable — but only with advisory-led structuring.

How Business & Beyond Handles DIFC Differently

Business & Beyond does not treat DIFC as a product.

The approach is:

Advisory-first, not form-first

Banking logic designed before incorporation

License and office aligned to substance, not cost

Governance and compliance planned from day one

There are no promises of speed or ease.

There is a methodology built around regulatory acceptance and long-term viability.

That difference becomes visible not at incorporation —

but at banking, audit, and regulatory review stages.

If you need high-quality, professional, and friendly business consulting, look no further than Business & Beyond Consulting.

Contact

Bromley – Kent , London UK

Copyright © 2025 – Designed by Business & Beyond – Dubai, UAE