- Mon-Fri 8:00 am-6:00 pm

- +971554475703

- info@businessandbeyond.ae

Start Your UAE Mainland Company with Business & Beyond – Faster, Compliant & Fully Transparent

Dubai mainland remains the gold standard for entrepreneurs who want full access to the UAE market, government projects, and the ability to trade anywhere in the region. With the UAE’s 100% foreign ownership reforms, streamlined licensing, and stronger banking systems, 2025 is the best time to establish your onshore company.

Business & Beyond Consulting LLC FZ specialises in end-to-end Dubai mainland business setup, from DET licensing to visas, banking, tax registration, compliance, and office solutions.

Our in-house chartered accountants and compliance specialists ensure you stay aligned with all UAE regulations from Day 1.

➡️ Get a Free Mainland Setup Cost Estimate

Why Choose Mainland Business Setup in Dubai in 2025?

Mainland companies, licensed by Dubai Economy & Tourism (DET), enjoy maximum flexibility, credibility, and unlimited trading opportunities.

Key 2025 Advantages

100% foreign ownership for most commercial & industrial activities

Trade anywhere in the UAE and internationally

Unlimited visas (based on office size)

Eligibility for government contracts & large tenders

High banking credibility

Flexibility to open branches across all Emirates

Access to Dubai’s skilled workforce & global logistics hub

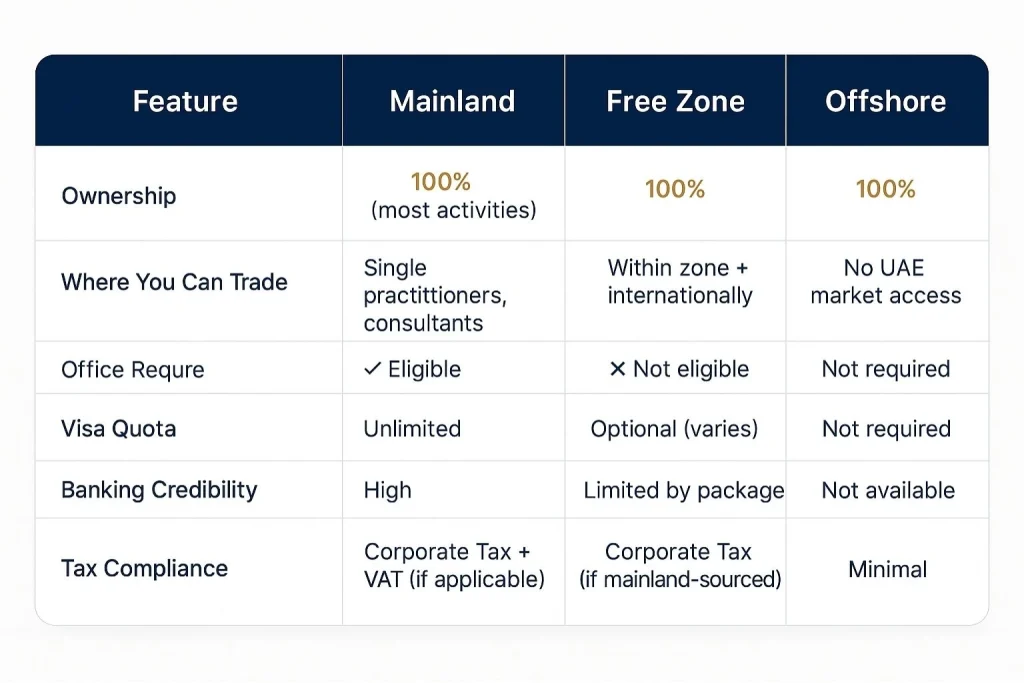

Mainland vs Free Zone vs Offshore (Quick Comparison)

➡️ Still unsure which jurisdiction suits you?

Talk to a Setup Specialist from Business & Beyond

What is a Dubai Mainland Company?

A mainland company is a business incorporated under Dubai Economy & Tourism (DET) and legally allowed to operate across the UAE without geographic restrictions.

You Can:

✓ Sell to UAE customers

✓ Bid for government contracts

✓ Hire employees freely

✓ Open multiple branches anywhere in the UAE

✓ Trade internationally without limitations

This flexibility makes mainland the preferred choice for trading companies, professionals, retail, logistics, manufacturing, and tech firms in 2025.

100% Foreign Ownership Rules (Updated for 2025)

In 2025, the UAE allows 100% foreign ownership in over 1,000 DET-listed activities, including:

Trading & general trading

E-commerce

Contracting

Consultancy & professional services

Manufacturing & industrial

Logistics, shipping, forwarding

Real estate brokerage

Hospitality, events, design & marketing

Activities that may still require a Local Partner or Special Approval

Some strategic sectors require additional conditions:

Defence & security-related sectors

Oil & gas activities

Certain financial services

Insurance

Telecom & media control activities

Legal advocacy (court representation)

Select healthcare and education activities require DHA/KHDA approvals

Business & Beyond conducts a full eligibility check before initiating your setup.

Types of Mainland Trade Licences in Dubai

1. Commercial Licence

For all trading-related activities:

General trading

Contracting

Retail & wholesale

E-commerce & online trading

Logistics & supply chain

2. Professional Licence

For service providers & knowledge-based firms:

Consultancy

IT services & software development

Marketing & creative services

Education & training

Legal consultancy

Medical services (DHA approval required)

3. Industrial Licence

For manufacturing & production activities:

Factories

Packaging units

Food production

Assembly and industrial operations

4. Special Licences

Some activities require external authority approvals:

DHA – medical/clinic

KHDA – education/training

DTCM – tourism & travel

SIRA – security services

DM – food & safety for restaurants

Legal Structures for Dubai Mainland Companies

➡️ Need help choosing the right legal structure?

Speak to our licensing experts.

Step-by-Step Process: Mainland Business Setup in Dubai

This is the exact, compliant process Business & Beyond follows:

Step 1 – Define Business Activities (DET List)

Choosing the correct DET activity code is critical. It determines:

Licensing requirements

Approvals needed

Compliance obligations

Bank account eligibility

Step 2 – Choose Legal Structure & Licence Type

We recommend the optimal setup based on your goals: LLC, Professional Licence, Branch, etc.

Step 3 – Reserve Trade Name

We ensure your trade name meets UAE standards:

No religious words

No political terms

No offensive language

Must reflect activity

Must not duplicate an existing name

Step 4 – Obtain Initial Approval from DET

This approval confirms the government has no objection to your business.

Documents may include:

Passport/Emirates ID

Visa/entry stamp

Shareholder details

Preliminary business plan

Activity list

Step 5 – Draft MOA & LSA Agreements

Our legal team drafts:

Memorandum of Association (MOA)

Local Service Agent Agreement if applicable

Shareholding agreements (if required)

All documents are notarised in Dubai Courts.

Step 6 – Lease Office & Register Ejari

Mainland companies require a physical office or a flexi-desk depending on the activity.

Business & Beyond helps you secure:

Flexi desk

Serviced office

Shared workspace

Dedicated office

Warehouse (if needed)

Ejari registration is mandatory for licence issuance.

Step 7 – Obtain External Approvals

Based on your activity:

DHA (health)

KHDA (education)

SIRA (security)

DTCM (tourism)

Dubai Municipality (food safety)

We manage all submissions end-to-end.

Step 8 – Pay Government Fees & Issue Trade Licence

Once approvals are cleared, DET issues your Dubai Mainland Trade Licence.

Step 9 – Immigration & Labour Setup (MOHRE & GDRFA)

We handle:

Establishment Card

Labour file

Investor visa

Employee visas

Medical test & Emirates ID

Dependents’ visas

Step 10 – Corporate Bank Account Opening

We prepare a full KYC-compliant file and liaise with top UAE banks.

New Update:

Dubai’s Unified Licence framework has significantly reduced bank onboarding time for compliant mainland companies.

Cost of Mainland Business Setup in Dubai

Typical Cost Range: AED 15,000 – AED 40,000

(depends on activity, office, visas & approvals)

Sample Cost Scenarios

Scenario A – Solo Consultant (Professional Licence)

| Item | Cost (AED) |

|---|---|

| Trade Name + Initial Approval | 1,000 |

| Professional Licence | 8,000 – 12,000 |

| Flexi Desk Office | 5,000 – 9,000 |

| Investor Visa | 3,500 – 5,000 |

| Total Estimate | 17,500 – 26,000 |

Scenario B – Trading Company (LLC – 2 Shareholders)

| Item | Cost (AED) |

|---|---|

| Trade Licence | 10,000 – 15,000 |

| MOA Notarisation | 1,000 – 2,500 |

| Ejari + Office Lease | 12,000 – 18,000 |

| Visas (3–5) | 10,000 – 20,000 |

| Total Estimate | 30,000 – 50,000 |

Scenario C – SME with Team & Larger Office

| Item | Cost (AED) |

|---|---|

| Licence + Approvals | 12,000 – 18,000 |

| Office Space | 20,000 – 50,000 |

| Visas (8–12) | 25,000 – 40,000 |

| Total Estimate | 55,000 – 100,000 |

➡️ Get an exact quotation tailored to your activity & visa count

Visa, Office & Bank Requirements

Visa Eligibility

Unlimited employee visas

Investor/partner visa (3 years)

Family & dependents sponsorship

Domestic staff visas possible

Office Options

Flexi desk

Serviced office

Coworking

Retail shop

Warehouse

Industrial facility

Bank Account Setup

Top UAE banks require:

Proper activity & business plan

Clear ownership structure

Physical office address

KYC-compliant documentation

Compliance Checklist for Mainland Companies

Annual Requirements

Trade licence renewal

Ejari renewal

Corporate tax return filing

VAT registration (if turnover exceeds threshold)

VAT returns (quarterly)

ESR reporting (if applicable)

UBO reporting

Bookkeeping & financial statements

Regulatory Authorities Involved

DET – Licensing

MOHRE – Labour

GDRFA / ICP – Immigration

FTA – VAT & Corporate Tax

Dubai Municipality / DHA / KHDA – Sector approvals

Business & Beyond handles your full compliance lifecycle, reducing risk & penalties.

Common Mistakes to Avoid

❌ Choosing the wrong activity → Bank account rejection

❌ Using a trade name that violates UAE rules

❌ Not verifying visa quotas

❌ Setting up in a free zone but selling to UAE Mainland customers

❌ Missing ESR, UBO, VAT deadlines → heavy fines

❌ Taking “cheap licence packages” that exclude compliance

Business & Beyond – Mainland Setup Packages

Starter (Consultants & Professionals)

Professional licence

Flexi desk

MOA/LSA documentation

Investor visa

Bank account assistance

Growth (Trading & Multi-Visa Companies)

LLC licence

Office assistance

3–7 visas

Tax registration

ESR/UBO compliance

Scale (SMEs & Investors)

10+ visas

Warehouse/retail approvals

DHA/KHDA/SIRA approvals

Customs code registration

Full compliance management

Why Partner with Business & Beyond?

✓ 1,500+ successful UAE company formations

✓ Specialized in Dubai Mainland, ADGM, and free zone structures

✓ Chartered accountants, tax agents & compliance experts in-house

✓ Seamless DET, MOHRE, GDRFA & FTA coordination

✓ Transparent pricing – no hidden fees

✓ Faster setup with complete documentation accuracy

Micro Case Examples

Retail Trading LLC – 2 shareholders

Fully licensed in 9 days with 4 visas issued and bank account opened in 14 days.Marketing Consultancy – Solo Expat Owner

Professional licence issued in 48 hours, VAT registration completed within 5 days.

FAQs – Mainland Business Setup in Dubai (2025)

1. Can I really own 100% of my mainland company?

Yes. Most activities now allow 100% foreign ownership.

2. Do I need a local sponsor?

Only for restricted activities. For most businesses, no.

3. How long does mainland setup take?

Typically 1–2 weeks if no external approvals are required.

4. Is a physical office mandatory?

Yes, a flexi desk or office is required for mainland licences.

5. Can I get unlimited visas?

Yes, based on your office size (approx. 100 sq ft per visa).

6. What are the corporate tax rules?

0% up to AED 375,000 profit, 9% above – if applicable.

7. Do I need VAT registration?

Mandatory if taxable supplies exceed AED 375,000 annually.

8. Can I sponsor my family?

Yes, investor visa holders can sponsor dependents.

9. Can I trade across Dubai & UAE?

Yes, mainland companies have full local market access.

10. Can my free zone company open a mainland branch?

Yes, via a branch structure.

11. Can I upgrade from free zone to mainland?

Yes, but it requires forming a new mainland entity or branch.

12. Is banking difficult?

Not with proper documentation. We prepare your full KYC file.

13. Can I change my activity later?

Yes, subject to DET approval.

14. What if my Ejari expires?

Your licence cannot be renewed. You may incur penalties.

15. Do I need annual financial statements?

Yes. Banks and tax compliance require proper accounting.

Start Your Mainland Company in Dubai Today

Business & Beyond Consulting makes mainland company formation fast, compliant, and stress-free.

Get a Free Consultation & Cost Breakdown

📞 WhatsApp: +971 55 447 5703

📧 Email: info@businessandbeyond.ae

If you need high-quality, professional, and friendly business consulting, look no further than Business & Beyond Consulting.

Contact

Bromley – Kent , London UK

Copyright © 2025 – Designed by Business & Beyond – Dubai, UAE